Benefits Realization and Portfolio Value Management

Benefit realization is one of the hardest portfolio management processes to get right (after resource capacity planning). Yet, in spite of the challenges, it gets the most buzz of any PPM process. It is a hot topic among Portfolio Managers and PMO leaders and the Project Management Institute. Strictly speaking, benefits realization occurs at the project and program level, since these are the vehicles for delivering business value and executing strategy, but benefits realization must fit within an overarching value framework which is at the portfolio level. In this post, we will cover what benefits realization is and how to manage project and portfolio value across the portfolio management lifecycle.

What is Benefits Realization Management?

In short, benefits realization is about capturing the actual benefits (tangible and intangible) from a project (or program) following the completion of that work. Benefits realization often involves tracking the quantitative benefits of the project (e.g. financial benefits, operational benefits, etc.) so that senior leadership can answer the question “did we get the benefits from the project that we expected?” Projects have inherent value, and benefits realization is part of the accountability framework to increase the likelihood that organizations receive the intended benefits from completed projects.

Measuring project benefits also validates how well the portfolio governance team selected the right projects. Too often, the assumption is made that if we finish the project we will get the benefits that were identified at project initiation. This is a false assumption based on hope (remember, hope is not a plan). It would be like making an investment without ever being notified on the financial return on that investment. No one does this with their own investments, but companies do it all the time with project investments.

Why is a Benefits Realization Plan Important?

Developing a benefits realization plan with a benefits realization process is important for several reasons.

- Increases the likelihood that organizations receive the intended benefits from completed projects

- It helps improve business case development, which, in turn, increases the odds that the project portfolio will contain more winning projects going forward

- Verifies the accuracy of the forecasts provided in the planning phase of the project

- Enables a feedback loop to help improve project selection (lessons learned)

- Strengthens value management across the portfolio management lifecycle

- Lessons learned can help mature both project and portfolio management processes

Benefits realization is really about value management. The reasons for implementing a benefits realization process listed above lead us to the heart of this post, value management in the context of project portfolio management.

The Portfolio Value Management Framework

As we have covered in previous posts, portfolio management is a senior leadership discipline that drives strategic execution and maximizes business value delivery through the selection, optimization, and oversight of project investments which align to business goals and strategies. We cannot isolate benefits realization from the greater context of project portfolio management. Portfolio management is about maximizing and delivering value. Benefit realization is not merely something that happens following the completion of a project, A Project Management Office or Portfolio Manager is responsible for establishing a framework for assessing and monitoring project value throughout the portfolio lifecycle. Elements of this framework begin as ideas are being formed and projects initiated. Without having such a portfolio value management framework in place, it is very difficult for any PMO or Portfolio Manager to successfully assess and monitor project value throughout the project lifecycle. The portfolio value management framework must come first. We will now review value management across the PPM lifecycle as it relates to a singular project view.

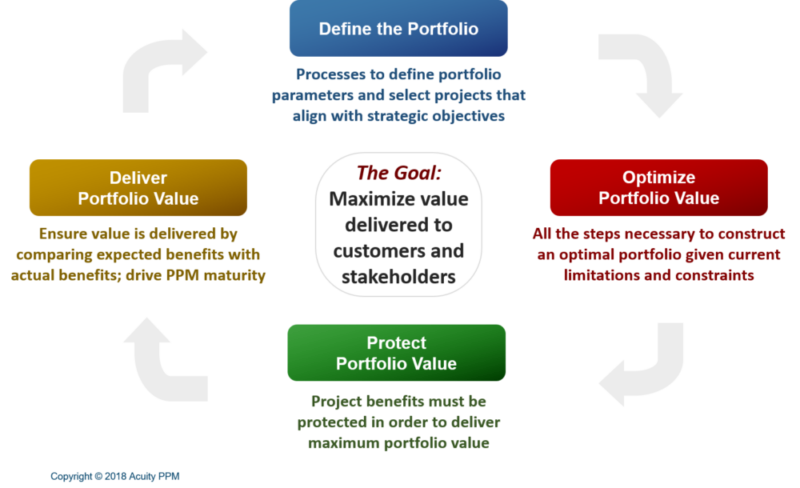

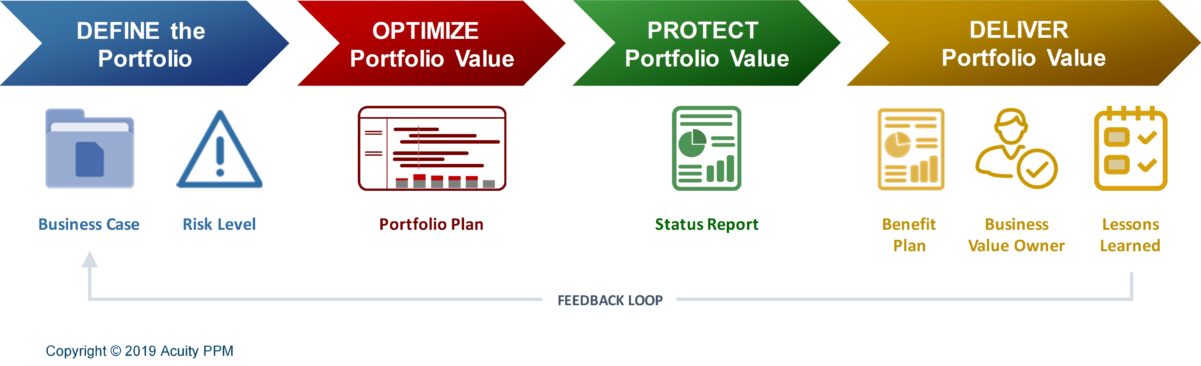

The four components of the portfolio management lifecycle include:

- DEFINE the portfolio: the processes to define portfolio parameters and select projects that align with strategic objectives and deliver more business value

- OPTIMIZE portfolio value: all the steps necessary to construct an optimal portfolio given current limitations and constraints

- PROTECT portfolio value: the steps that the portfolio governance team need to take to protect portfolio value

- DELIVER portfolio value: the steps to ensure that the value delivered is in line with expectations (this is where benefit realization occurs within the portfolio lifecycle)

Value Management and Defining the Portfolio

The first phase of the portfolio management lifecycle is defining the portfolio. This largely involves selecting the right projects for the portfolio and in this phase, we answer the question “what future state benefits are we expecting?” As we have discussed in our Work Intake and Phase-Gate posts, selecting the right projects is based on the relative project value. Projects with higher value should be considered for inclusion in the portfolio. Defining value is an integral step of portfolio governance. When we talk about project value, it can include tangible and intangible factors as well as qualitative value (e.g. strategic) and quantitative value (e.g. net present value, return on investment). The portfolio governance team first needs to define what constitutes value to their organization in order to conduct fair project assessments.

Benefits Realization and the Business Case

Based on the value definition, the governance team can select the right projects. One of the key tools in selecting projects is the business case. Every organization will have their own understanding of what a business case entails. For some, it could me a lengthy and detailed financial pro forma. For others, it could be a single slide in a presentation describing the relative value of the project. But for an organization to successfully measure project value and evaluate benefits after a project is completed, the governance team needs sufficient information to help measure the value of a project.

Benefits realization is inherently about measuring value. If you cannot measure the value of a project when it is initiated, you will not be able to measure the value it has delivered after it has completed. The business case needs to contain enough information so that baseline value can be defined for a project. Organizations serious about benefits realization need to document how the benefits are being measured as well as capture the assumptions behind the value estimates. For any project that includes financial benefits, cost-benefit analysis is very important and should not be done in a haphazard way.

Risk Assessments Affect Portfolio Value

Organizations looking to develop a robust value management process also need to consider project opportunities and risks. While a number of organizations track project risks during execution, fewer do a good job of addressing the riskiness of projects during project evaluation. The riskier a project is (based on inherent project risk factors which are discussed in our prioritization post), the less likely the project will achieve its intended benefits. Getting crisp about the risk factors facing projects helps the portfolio governance team select the right balance of projects according to their risk tolerance. In addition, there may be specific risks identified during Work Intake or another portfolio decision making framework that could impact value delivery. Project Managers and Sponsors should be keenly aware of specific project risks that negatively impact value delivery.

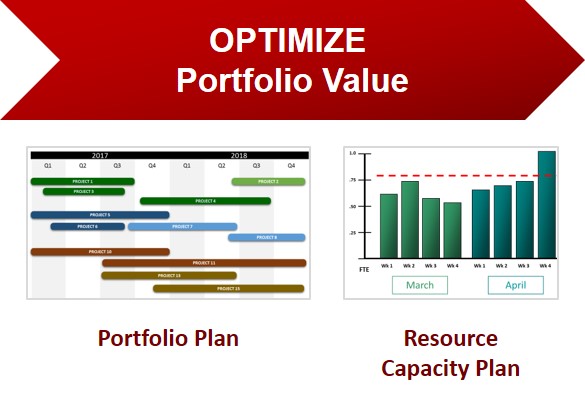

Value Management and Optimizing Portfolio Value

The second phase of the portfolio lifecycle is optimizing portfolio value; this includes all the steps such as prioritization, capacity planning, and portfolio planning to construct an optimal and realistic portfolio given current limitations and constraints. Projects operate within the context of an entire portfolio environment, not in a vacuum. In order for senior leaders to realize maximum project value, they must account for project priorities, sequencing, project dependencies, and resource capacity.

Project Priorities are Based on Project Value

Portfolio management is about maximizing project value delivery and in our post on prioritization, we discussed that priorities are based on relative project value. Prioritization is directly related to resource allocation and project timing. Higher value projects are more likely to get the right resources with adequate availability. Lower value projects are more likely to share resources and are at higher risk of not getting adequate availability. Project priorities are a major factor for whether a project can maximize value delivery.

Good Capacity Planning Increases the Odds of Value Delivery

Resource constraints are a hidden factor that jeopardizes project delivery. Organizations should not fly blind in regards to the capacity and utilization of their critical resources, otherwise they will significantly increase the risk of project failure. Organizations that are serious about benefits realization must develop solid resource capacity planning processes. Without solid capacity planning, critical resources can be over-utilized which means projects are competing for the same resources. This has the negative effect of extending project duration (thereby reducing project benefits) or reduces the quality of project deliverables due to a lack of availability.

Portfolio Planning Sequences Projects

Portfolio Planning at this life cycle stage is focused on optimizing the sequencing and timing of approved projects based on resource constraints, dependencies, and priorities. Good sequencing can optimize portfolio delivery and mitigate some of the risks associated with constrained resources. In addition, managing project dependencies is another dimension to sequencing projects. Without visibility of key dependencies, some projects may get blindsided by another impacting project, get derailed from their schedule, and reduce project benefits.

Protecting Portfolio Value is Critical to Value Management

The third phase in the portfolio management lifecycle is protecting portfolio value during project execution; this entails steps to protect project benefits in order to deliver maximum portfolio value. The portfolio governance team has an important role to play during project execution – ensuring project success. Keeping projects moving forward, monitoring project performance, clearing obstacles, managing portfolio level risks, ensuring projects have sufficient resources are all part of this lifecycle stage; these steps help protect project delivery and ensure that projects can deliver maximum value to the business.

Deliver Portfolio Value

The fourth and final phase of the portfolio management lifecycle is delivering portfolio value. This phase is about ensuring current and future portfolio value is delivered by comparing expected benefits with actual results. It answers questions such as:

- “How will we track the benefits?”

- “Are we getting the benefits we intended?”

- “Who is responsible for realizing the project benefits?”

- “Have we learned why we may not receive full benefit and how to remedy this in the future?”

Now that we have covered the importance of value management in the context of the portfolio management lifecycle, let us now look at the details of the benefits realization process.

What Does a Benefits Realization Process Look Like?

Most project benefits are realized once a project is completed (Agile software development is a notable exception to this statement and may be addressed in a future post). Therefore, the crux of realizing project benefits comes after project completion. There are several components to successfully managing project benefits:

- Benefits plan: The benefits realization plan is a deliverable that the project team creates before the project is completed. At a minimum, the benefits plan should detail out the specific benefits being delivered, the beneficiaries of the benefits, when the benefits will be realized, when and how the benefits will be measured, who will measure the benefits, who is the Business Value Owner, and how benefits will be sustained. Additional tools included in the benefits plan could include a benefits breakdown structure, benefits roadmap, benefits RACI, and benefits reports (courtesy of Morten Sorensen).

- Business Value Owner: the Business Value Owner is the single person ultimately responsible for ensuring that benefits are realized. There could be a Business Value Owner in each respective business unit or organization that is a beneficiary of the project, but there should be one person responsible for overall project benefits. Without this role, no one will have direct responsibility for overseeing the benefit realization of the project, and benefit realization will be left to chance. The Project Manager is responsible for managing the project in such a way so as to deliver the expected benefits defined in the business case, but once the project is completed, the Project Manager should not be directly responsible for tracking or realizing the benefits from the project.

- Lessons learned: good project management should include a lessons learned document. Sadly, even if organizations conduct lessons learned, it rarely completes a feedback loop to improve future projects. The lessons learned document should also be used to evaluate how project benefits changed over time and what could have been done differently to realize greater project benefits. This significantly elevates the importance of the lessons learned document; it is not merely about understanding how to complete a project better but what the team can do to ensure that project benefits are protected and increased.

- Project Risk and Opportunity Management: The Project Manager, PMO, and Portfolio Manager must monitor project related risks that could affect value delivery. Moreover, organizations should seek to understand potential project opportunities associated with a project. Opportunities are the positive aspect of risk, that is, these are positive outcomes that might happen. More mature organizations should implement opportunity management as part of their risk management process, but this requires a proactive approach to evaluate opportunities to enhance project value beyond the current statement of work. Project Managers and Benefit Owners should be responsible to identify areas where more value could potentially be delivered. This also requires a change in culture to look for value opportunities throughout the project lifecycle rather than focus on negative risks only. Very few companies conduct opportunity management as well as they do risk management, but opportunities are important for potentially increasing project value.

- Change management plan: a change management plan may be needed for some projects that have a higher degree of risk or complexity to implementing the project solution. Good organizational change management can make the difference in whether project benefits are implemented, adopted, and realized. The transition from the project team to operations should be understood within the change plan.

What are the Challenges of Benefits Realization Management?

Now that we have covered value management across the portfolio management lifecycle and the components of the benefits realization process, let’s now look at common challenges of benefits realization.

Defining Value

One of the basic challenges that companies have with portfolio management is defining what is valuable to the company. Without agreement from the portfolio governance team on what constitutes value, it is difficult to establish a benefits realization process.

Measuring Value (The Business Case)

Benefits realization is about measuring value. In many cases, measuring financial value is often easier than other value metrics. However, without a solid approach to measuring financial value, some organizations are jaded when it comes to cost-benefit analysis because people tend to inflate numbers without any real accountability for those numbers. Getting the Finance team involved with business case development can help ensure consistency from project to project.

Another important point related to measuring financial benefits is that the benefits need to be tangible and “bankable”. Some cost-benefit analysis may indicate that implementing a certain system will save the company X number of hours per year at an annual savings of Y dollars. The question though is whether we can actual bank those savings. Are those real dollars saved? Probably not, people will still continue to work the same number of hours, but would simply have time to work on other tasks. The only way we can bank those saved hours is if we can show how those saved hours will be applied to other work. It may still be valuable, but likely not bankable in a financial sense. This is why getting the Finance team involved in cost-benefit analysis is very important so that there is a sound approach to calculating benefits.

Monitoring Project Value (During Project Execution)

After the business case is developed and the project is approved, it may be several months before the project is completed. In between this time, internal and external factors could have significant effect on the value that is being delivered. Rather than waiting several months after a project has completed to begin validating the original business case, some organizations do a quick review of the financial business case at each gate review. In this way, if project value has deteriorated, the portfolio governance team can take appropriate action to remedy. Project portfolio management software such as Acuity PPM provides portfolio charts and dashboards to help track portfolio value.

Measuring Project Value (Post-Completion)

The biggest challenge with benefits realization is simply doing it. Virtually every organization is overloaded with projects, and teams are relieved just to complete a project. Once projects are completed, the completed project is celebrated and then forgotten as everyone moves on to the next project. Rarely is a person ever assigned to measure and analyze the benefits of the completed projects. Benefits realization sounds great on paper, but unless leadership allocates real people to spend real time tracking and analyzing benefits, it won’t happen.

Accountability for Achieving Project Benefits

In addition to actually tracking and analyzing benefits post-completion, the next biggest challenge is accountability. Someone needs to be responsible for achieving the intended benefits detailed in the business case. Without accountability, you are left with hope (and hope is not a plan). The Business Value Owner plays a strong role in this process by having responsibility for achieving project benefits. This person may be the same as the Project Sponsor. The Business Value Owner role may be a new concept to some people, but essentially it is about designating a senior leader to be ultimately responsible for achieving project benefits.

Years ago at the Boeing Company, I was impressed that when project proposals got submitted to the IT Governance board, the business case (cost-benefit analysis) got updated and reviewed at various check points. At a certain approval point, the sponsoring organization would update their long-range business plan to account for the future benefits. In other words, the organization would reduce their long-range budget by the amount of the financial savings. This would ensure that organizations firmly believed in the financial benefits of their projects and drove a high level of accountability, which is very important for making the process work.

Weak Feedback Loop

One of the promises of a benefits realization process is that it can help improve future benefit estimation and make the entire project selection process more effective. However, even when benefits are tracked and the gaps are analyzed, it does not mean that this information is shared with future project teams, Finance, portfolio governance, etc. The portfolio communication feedback loop with information on how to make better estimates is an important component of the benefits realization process.

VIDEO: PPM 101 – Benefits Realization

Benefits Realization and Portfolio Maturity

In an earlier post we covered portfolio maturity. Many of the points covered above are for organizations with mature processes and enough rigor to successfully manage a benefits realization process. Having a robust Intake process (with good business cases), prioritization, capacity planning, and portfolio planning, are all important ingredients in making benefits realization work. Organizations can carry out some of the mechanics of a benefits realization process without the aforementioned processes, but to be successful at overall value management, which is the heart of portfolio management, organizations need to strive for level 3 maturity or higher.

Tim is a project and portfolio management consultant with over 15 years of experience working with the Fortune 500. He is an expert in maturity-based PPM and helps PMO Leaders build and improve their PMO to unlock more value for their company. He is one of the original PfMP’s (Portfolio Management Professionals) and a public speaker at business conferences and PMI events.

[activecampaign form=3]

What is Benefits Realization Management?

Benefits realization is about capturing the actual benefits (tangible and intangible) from a project following the completion of that project. Benefits realization often involves tracking the quantitative benefits of the project so that senior leadership can answer the question “did we get the benefits from the project that we expected?”

Why is Benefits Realization Important?

Developing a benefits realization process is important for several reasons: it increases the likelihood that organizations receive the intended benefits from completed projects, it helps improve business case development, it verifies the accuracy of the forecasts provided in the planning phase of the project, it enables a feedback loop to help improve project selection based on lessons learned, and it strengthens value management across the portfolio management lifecycle.

What Does a Benefits Realization Process Look Like?

There are several components to a successful benefits realization process including a benefits plan (that details the specific benefits being delivered, the beneficiaries of the benefits, when the benefits will be realized, when and how the benefits will be measured, and who will measure the benefits), a Business Value Owner who is responsible for ensuring benefits are realized, lessons learned to provide a feedback loop for developing better business cases in the future, and a change management plan.

What are some of the challenges associated with benefits realization?

Some of the challenges include not having a consistent and sound approach for measuring benefits, not monitoring the change in benefits over the course of the project lifecycle, not designating people to measure benefits after a project has completed, and not having a senior leader accountable for the benefits.

Never miss an Acuity PPM article

Don't take our word, listen to what others are saying:

"I find value in all of your articles."

"Your articles are interesting and I am sharing them with my team who have limited project knowledge. They are very useful."