Assess Portfolio Maturity Early and Often

Portfolio maturity levels represent the level of sophistication around portfolio management processes, tools, and people. It helps identify shortcomings in PPM processes (current state) and can be used to establish improvement goals to reach a better future state. A portfolio maturity model is a tool to assess the level of sophistication in the processes, tools, and people involved in managing the project portfolio process. Measuring your organization’s portfolio maturity is critical for the long-term success of strategic portfolio management. Organizations that do not periodically assess their maturity and progress toward maturity goals will fail to realize the benefits of project portfolio management. Having worked with many Fortune 500 companies, I wish I got a dollar every time someone told me “we’ll get there.” Unfortunately, the statistics imply a sad ending, “you won’t get there”. That’s why we encourage organizations to assess their portfolio process maturity early and often.

Why Measuring Portfolio Maturity Is Important

According to Gartner, around 80% of PMO’s are level 1 or 2 maturity. Let that sink in. Unless you know you are an elite PMO, you are part of the 80%. In fact, without actively maturing your organization’s portfolio processes, you will remain in that 80% for many years. Organization’s simply don’t “get there” by the passage of time; it takes active work to achieve desired improvement targets to arrive at better portfolio management processes.

Managing portfolio maturity is a critical process for ensuring that organizations develop the right amount of process based on the needs of the organization. In this way, portfolio implementations are “right-sized”, which means that no processes are implemented until needed by the organization. Over-engineering the portfolio management process too early can create an unnecessary weight on the organization and can cripple an implementation. Using a maturity model is a great way of balancing the needs of the organization with useful process development. A good Portfolio Manager will take ownership of measuring portfolio maturity and advancing portfolio management processes.

Portfolio Maturity and PPM Software

Acuity PPM is hyper-focused on this concept of organizational maturity because we have seen many companies fail to adopt and utilize traditional PPM software. As we have discussed in a previous post, most Project Management Offices (PMO’s) never fully utilize the functionality of their PPM software because of their current capability maturity level. The overwhelming majority of PMO’s are new or have slowly matured and can only utilize a limited amount of functionality. We firmly believe that companies should only pay for what they need, not pay for what they don’t need (click here to learn about the tragic reality of most PPM software).

At the same time, portfolio management maturity models can be a great enabler in making process improvements. Higher maturity often translates into a greater realization of the benefits of PPM. Portfolio management maturity models are very useful for assessing the current state of the portfolio processes and how to arrive at a higher level of maturity. Yet, we do not advocate maturing simply for the sake of maturing, rather we encourage customers to identify their target maturity state.

Measuring your organization’s portfolio maturity is critical for the long-term success of strategic portfolio management. Organizations that do not periodically assess their maturity and progress toward maturity goals will fail to realize the benefits of project portfolio management.

However, identifying the future state of portfolio management processes is rarely discussed in portfolio management literature. Companies simply set out on the PPM journey hoping to reach the higher levels of maturity (reminder: hope is not a plan). Actually, most organizations do not need to strive for level 5 maturity (an elusive and mostly theoretical state of maturity to say the least). However, if your organization can make a determination of where your portfolio processes need to be within 2-3 years, you could establish a legitimate competitive advantage. Having this understanding would give your organization a realistic target for improvement. [FEATURE: portfolio management maturity assessment tool]

Critics of maturity models tend to point out that many companies blindly follow a maturity model without any regard for developing value-added capabilities. We agree that companies should not try to “mature” for maturity sake, but maturity models help identify opportunities for developing valuable capabilities and processes that help the organization drive more business value. We believe that maturity models help organizations take an objective view of their current capabilities and identify opportunities to improve and increase business value.

Project Criticality and Portfolio Magnitude to Inform Portfolio Maturity

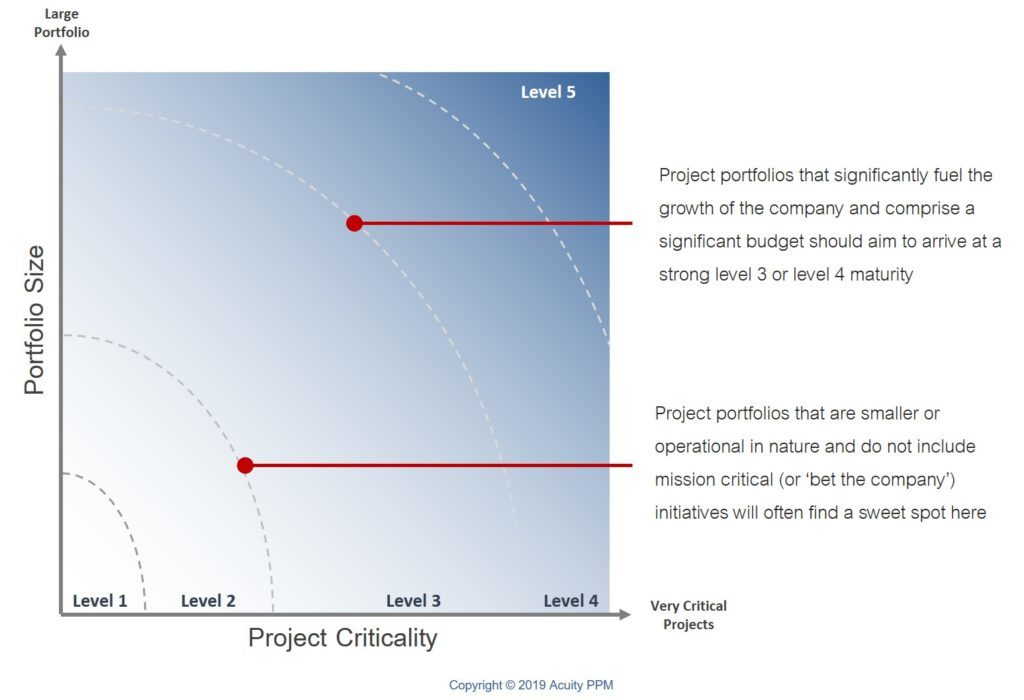

Generally speaking, you can make an initial determination of your target maturity based on two important factors: project criticality and portfolio magnitude/size. Project criticality refers to the importance of projects to the organization and includes factors such as: driving growth and revenue for the company, high strategic importance, projects where the risk of failure would impact the company and/or where the risk of not doing the project is high, and critical dependencies to other high value projects. Portfolio magnitude refers to the size of the portfolio in terms of: total portfolio budget, number of project resources, breadth of impact to the company (local, regional, national, international), etc.

In order to make a realistic assessment of future state portfolio processes, the portfolio management team first needs to make an honest assessment of project criticality by asking some basic questions:

- How much of our portfolio is comprised of operational projects compared to strategic projects?

- How much of the company’s growth plans are tied up with the projects in our portfolio?

- If our biggest projects failed, would this impact our P&L or need to be reported to the board of directors?

The chart below conceptually depicts how to identify the organization’s target maturity after assessing project criticality (along the x-axis) and portfolio size/magnitude (along the y-axis). Project portfolios that are smaller or operational in nature and do not include mission critical (or ‘bet the company’) initiatives will often find a sweet spot around level 2 or 3. Project portfolios that significantly fuel the growth of the company and comprise a significant budget should aim to arrive at a strong level 3 or level 4 maturity. In rare cases, due to large portfolio size and mission critical projects, some companies should strive for level 5 maturity.

Portfolio Maturity Levels

Our discussion around portfolio maturity levels is based on the capability maturity model from CMMI Institute. In this model there are five basic levels of maturity from 1-5. A full assessment of portfolio maturity would have a number of criteria to evaluate, but we can provide some basic characteristics of each level below. In addition to evaluating project criticality and portfolio magnitude, each organization should also consider at what level of caliber they need to perform at in order to be successful.

Level 1—INITIATION (“Ad Hoc”)

The key word for level 1 is “inconsistency”. No standards exist at this level, many project and portfolio processes do not exist at this level, and what does exist is applied in an ad hoc way. What little processes are in place are carried out in an ad hoc fashion.

Level 2—DEVELOPING (“Emerging Discipline”)

At level 2, some standardization of processes exist, although most processes are still immature. Nevertheless, some processes are defined and documented (such as Work Intake), and the organization is getting some benefit from portfolio management. At this stage, the organization should have visibility of all major projects in a central tool. The primary focus is on getting setting up a portfolio governance team with basic governance standards and processes set up for reviewing project requests. Basic prioritization may begin at this point with rudimentary understanding of resource capacity management.

Level 3—DEFINED (“Responsive”)

Level 3 is a significant step for the organization as it regularly and effectively uses portfolio mechanics. Processes are well defined and established in the organization, with process documentation made freely available to the organization. Level 3 signifies the real shift from a single project view to an aggregate portfolio view. In the previous two levels, even though there is visibility of the portfolio as a whole, emphasis was placed on individual projects. By level 3, organizations better understand how projects interact with each other. Governance bodies seek to understand the implications to the portfolio based on specific project decisions, the key question being “what will this do to the portfolio?”

Level 4—MANAGED (“Proactive”)

Level 4 marks the advance of the organization in its use of portfolio management. Here governance bodies begin to utilize optimization techniques to drive even greater value to the portfolio with little or no extra cost. Project Management Offices (PMO’s) are advanced as well, enabling the organization to collect higher quality data that can be used for various optimization techniques, such as resource capacity optimization. The organization feeds the portfolio system regularly with accurate and up-to-date project information. Users of the portfolio system feel very comfortable with the tool and can use many of the advanced features. Prioritization as a project selection tool has been replaced by efficient frontier analysis. Schedule optimization is used to unlock even greater value from the portfolio.

Level 5—OPTIMIZED (“Advanced”)

The key difference between level 4 and 5 is that at level 5, there is so much organizational rigor and process discipline that the organization proactively uses optimization techniques, and does so with little or no resistance. Quality data is constantly fed into the portfolio system. Several enterprise systems are integrated with the portfolio system making it a critical system for the performance of the organization. Senior management from across the company rely upon project and portfolio reports for making organizational decisions.

Again, it is not necessary to target level 4 or 5, but companies in highly competitive and profitable industries (such as tech) should seriously consider bolstering their portfolio management processes to improve strategic execution. Let’s look at a quick example.

VIDEO: How to Use a Portfolio Management (PPM) Maturity Model

Portfolio Maturity Case Study

In April of 2010, Apple released the first iPad. Not wanting to be left behind, Hewlett-Packard purchased the company, Palm for $1.2 billion dollars. It was said, “Palm’s innovative operating system provides an ideal platform to expand HP’s mobility strategy…Advances in mobility are offering significant opportunities, and HP intends to be a leader in this market.” Near the end of 2010, Léo Apotheker was named the CEO and President of Hewlett-Packard. He was known as a strategic thinker with a passion for technology, wide-reaching global experience and proven operational discipline – “he is exactly what we were looking for in a CEO…We are at a critical moment and we need renewed leadership to successfully implement our strategy…”. However, Hewlett-Packard was unable to execute its mobile strategy and failed to compete with Apple in the mobile space. 2011 turned out to be such a bad year for HP that they even announced that they would get out of the PC market, an industry they had dominated for years. Moreover, in less than 12 months as CEO, Léo Apotheker was fired. “The problem with Apotheker wasn’t lack of vision as much as a lack of execution and communication”.

Numerous factors (including poor leadership) contributed to HP’s demise in the PC and mobile markets. It would be an oversimplification to suggest that weak portfolio maturity alone led to HP’s exit from the mobile market. Yet, there are several important points to be made from this case:

- Companies only need to strive for higher levels of maturity if they compete against very strong companies

- In order to compete with a company like Apple, a company must have championship caliber strategic execution capabilities (level 5).

- A company could have a good product and do a good job of executing its strategy (level 3), but if its competitors are even stronger at execution, that company could easily fail.

Portfolio Maturity Assessments

A thorough portfolio maturity assessment would include the following areas:

- Ideation – the process for generating new project ideas. The goal is to collect the best ideas and generate high quality projects.

- Work Intake – the process of collecting and developing new project proposals for a go/no-go decision.

- Gated Governance Framework – a particular governance structure to evaluate, authorize, and monitor projects throughout the project lifecycle.

- Prioritization – the process of evaluating project value often with the use of weighted scoring model

- Portfolio Optimization – refers to optimization techniques to maximize portfolio value

- Portfolio Planning – the process of creating an optimal portfolio based on resource constraints and project interdependencies

- Resource Capacity Planning – the process of evaluating resource utilization and comparing it against available capacity to do work

- Portfolio Risk Management – manage portfolio level risks and portfolio risk tolerance

- Portfolio Communication – processes for a Portfolio Manager to communicate all aspects portfolio management

- Portfolio Reporting and Analytics – charts, dashboard, and analytics for projects and portfolios

- Portfolio Value Management – processes to track project benefits and measure it at the portfolio level

- Project Monitoring – status reports to track project health and performance

- Portfolio Governance – the portfolio goverance team are the primary decision makers in the portfolio process

Based on the current state maturity assessment, a future-state roadmap should be developed that highlights key process improvement areas across a 1-3 year period of time. Measuring the current portfolio maturity level is only the first step. Without ongoing concerted effort, organizations will not reach their targeted maturity. Acuity PPM can help you with both your current and future state maturity assessments. Contact us today.

Tim is a project and portfolio management consultant with over 15 years of experience working with the Fortune 500. He is an expert in maturity-based PPM and helps PMO Leaders build and improve their PMO to unlock more value for their company. He is one of the original PfMP’s (Portfolio Management Professionals) and a public speaker at business conferences and PMI events.

[activecampaign form=3]

What is a portfolio management maturity model?

A portfolio management maturity model is a tool used to assess the quality and sophistication of various portfolio management capabilities including: ideation, work intake, Stage-Gate, prioritization, portfolio optimization, portfolio planning, resource capacity planning, portfolio risk management, portfolio communication, portfolio reporting and analytics, portfolio value management, project monitoring, and portfolio governance.

Why should I measure project portfolio maturity?

Measuring your organization’s portfolio maturity is critical for the long-term success of strategic portfolio management. Organizations that do not periodically assess their maturity and progress toward maturity goals will fail to realize the benefits of project portfolio management.

What are the five levels of a portfolio management maturity model?

Level 1—INITIATION (“Ad Hoc”): no standards exist at this level. Level 2—DEVELOPING (“Emerging Discipline”): some standardization of processes exist, although most processes are still immature. Level 3—DEFINED (“Responsive”): Processes are well defined and established in the organization, with process documentation made freely available to the organization. Level 4—MANAGED (“Proactive”): governance bodies begin to utilize optimization techniques to drive even greater value to the portfolio with little or no extra cost. Level 5—OPTIMIZED (“Advanced”): at level 5, there is so much organizational rigor and process discipline that the organization proactively uses optimization techniques, and does so with little or no resistance.

Never miss an Acuity PPM article

Don't take our word, listen to what others are saying:

"I find value in all of your articles."

"Your articles are interesting and I am sharing them with my team who have limited project knowledge. They are very useful."