Strong Project Portfolio Governance Delivers Results

Strong project portfolio governance is the number one success factor for making portfolio management successful. Unfortunately, most companies struggle with governance. In fact, when you hear the word ‘governance’, what comes to mind? Do you think of bureaucracy, lots of meetings with few or no decisions, unclear expectations, poor accountability, strife between decision makers, inconsistent decision making? These issues are really just the symptoms of poor governance. In this post, we are going to focus on what project portfolio governance is and why it is important and provide success factors to help your governance teams improve their governance processes.

“Effective IT governance is the single most important predictor of the value an organization generates from IT”¹

What is Project Portfolio Governance?

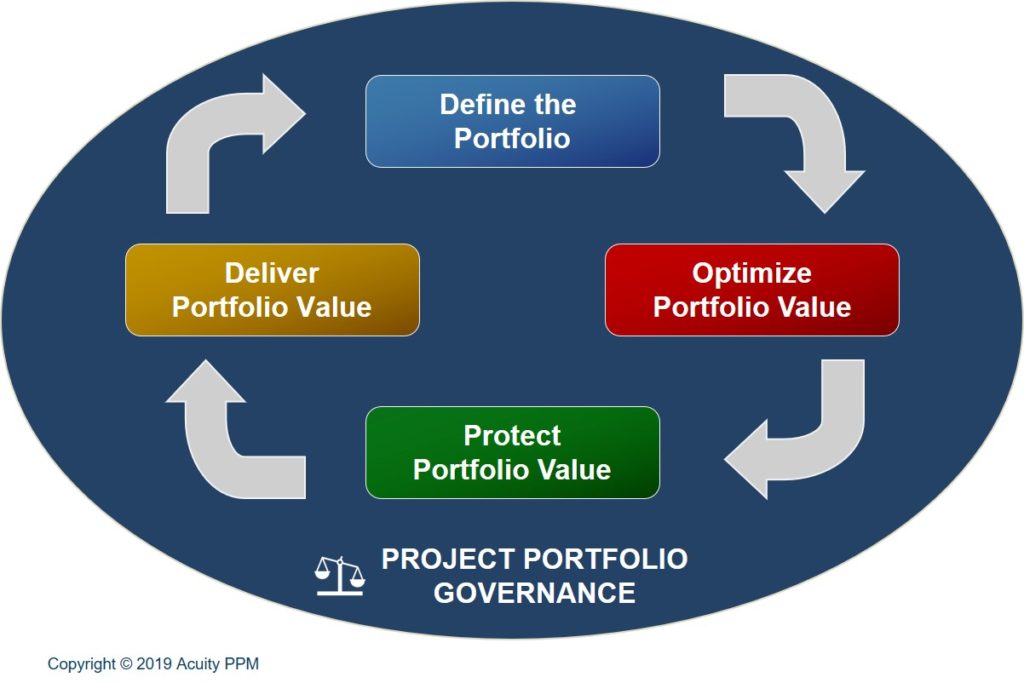

At its core, project portfolio governance is about strategic decision making. When we talk about project portfolio governance we are referring to the governance of all projects in the portfolio. The graphic below highlights that all four components of the portfolio management lifecycle depend on good project governance. From a portfolio management perspective many of the critical decisions involve project selection (Defining the Portfolio), prioritization and resource allocation (Optimizing Portfolio Value), project performance (Protect Portfolio Value) and realizing project benefits (Delivering Portfolio Value). Portfolio governance is the foundation of project portfolio management.

According to Peter Weill and Jeanne Ross, experts in information technology governance, governance can be defined as “specifying the decision rights and accountability framework to encourage desirable behavior…”. Clearly, this refers to the people making decisions, a process for making decisions, and accountability to help ensure that good decisions are made.

“Portfolio management without governance is an empty concept” ²

In practice, the tension is about how to make project portfolio governance both effective and efficient. Project portfolio governance can be effective but requires a significant amount of time from project teams to collect data, the Portfolio Manager to create the right portfolio management charts, and for the governance committee to sift through the reports and data to make better decisions. Project Management Offices (PMO’s) may also take a “lean” approach to project portfolio governance that is apparently efficient that requires little effort from the governance committee, but is inadequate or completely ineffective. Our goal is to balance effectiveness against efficiency to ensure that the portfolio is properly managed and delivering maximum value.

Why is Project Portfolio Governance Important?

Project portfolio governance is important because it is the foundation of all portfolio management activities. According to Howard A. Rubin, a former executive vice president at the Meta Group, “a good governance structure is central to making portfolio management work.” Hence, well-defined and properly structured governance is critical to manage the portfolio. Let’s define good portfolio governance as having the right people making good strategic decisions with the right information at the right time.

- The right people – having the right decision makers means having people at the right level of authority and breadth of knowledge to make decisions. Having the wrong people involved (or missing the right people) means that decision quality is compromised, a decision can’t be made or must be revisited later, or that a decision will be challenged. None of these are desirable outcomes and should be avoided. Empowering the right decision makers within the organization is very important. In addition, different levels of management may participate in different types of portfolio decision making. Identifying which people make certain decisions is part of having the right people for project portfolio governance.

- Good strategic decisions – the goal of portfolio management is to maximize organizational value, and good portfolio management by definition is about making trade-offs, which means not everything can get done. Good strategic decisions include “no” or “no, not right now”. Saying “no” is a critical success factor for project portfolio governance. If the governance committee approves most projects or makes everything a priority, portfolio value is diminished. It is also critical for the governance team to agree on HOW it will make decisions.

- The right information – even if the right decision makers are present and capable of making good portfolio decisions, having too much or too little information frustrates the decision-making process. Not only do decision makers need to know how to use portfolio data, but they need the right data, otherwise they will make sub-optimal portfolio decisions. Governance includes the processes for collecting quality data in a timely way.

- The right time –a governance team needs to meet on the right cadence to address portfolio matters. Project approvals, prioritization, status reviews, capacity planning, all need to be conducted on a consistent cadence. This doesn’t mean that all of these activities have the same cadence, only that they occur on a consistent basis to ensure the portfolio is properly managed.

“Good governance design allows enterprises to deliver superior results on their [project] investments.” ¹

The Portfolio Governance Team

Setting up a portfolio governance team is a critical first step in establishing portfolio governance. Until there is a governance team, there is no governance. The composition of the portfolio governance team is important as the effectiveness of portfolio governance and strategic decision making is directly correlated with the ability of the governance team to make decisions that carry weight and will be respected across the organization. Governance teams composed of junior leaders often need their decisions “blessed” by one or more senior leaders before they are really approved. This is considered weak governance.

Organizations that don’t take this serious will miss the mark on portfolio management – get the right leaders together who can effectively make serious strategic decisions for the organization. After all, we’re talking about making critical strategic decisions that impact the organization’s ability to accomplish strategic goals; it’s worth putting in some time and energy to make it work. Sadly, many organizations go through the motions of governance without ever really getting the benefit of portfolio management. Moreover, it’s easier for everyone to avoid contention by saying ‘yes’ to proposals rather than have a healthy debate over whether projects should be approved and how they should be prioritized.

Effective portfolio governance relies on an effective portfolio governance team. Simply bringing senior leaders together does not automatically constitute a team. The governance team should have limited membership but adequate representation of organizations impacted by projects in the portfolio. Each member should bring something unique to the team to add value to the governance team.

The Accountability Framework

In order to achieve support results on project investments, it is paramount that good strategic decisions are consistently made and then properly executed. In order to ensure that good decisions are made that maximize portfolio value and benefit the organization, accountability mechanisms need to be put in place. Accountability may also be synonymous with fair and equitable processes as well as transparency. ‘Accountability’ and ‘accountable’ have strong positive connotations; they hold promises of fair and equitable governance. It comes close to ‘responsiveness’ and ‘a sense of responsibility’, a willingness to act in a transparent, fair, and equitable way. Governance teams must then demonstrate their accountability for the appropriate, proper and intended use of resources. This is what project portfolio governance is about. Furthermore, it is good leadership that drives accountability. True leaders hold decision makers accountable for their decisions.

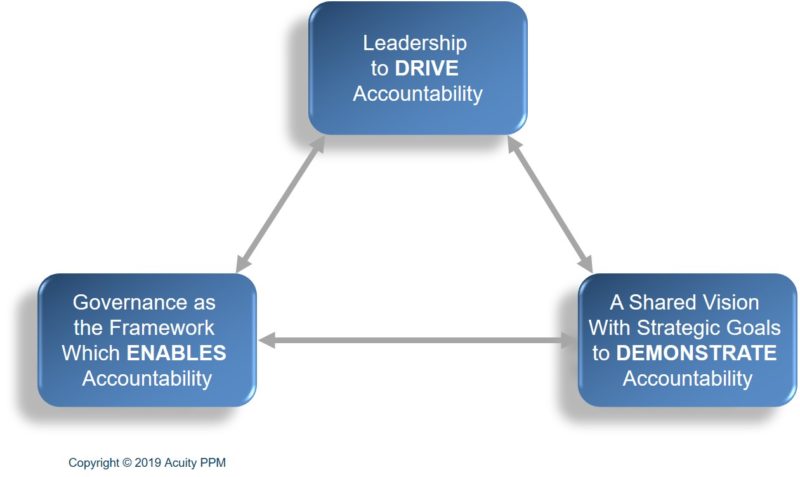

The diagram below captures the three elements of the accountability framework.

- Leadership to drive accountability

- Governance as the framework which enables accountability

- A shared vision with strategic goals to demonstrate accountability

The rest of this post will focus on the first two elements and will close with critical success factors for effective and efficient project portfolio governance.

Leadership Drives Project Portfolio Governance Accountability

Leadership is at the heart of governance for it is people who make decisions, but not all decision makers are leaders, and by extension, not everyone on a governance team is a leader. Yet, when the governance council has true leaders and this leadership team truly functions as a team, then strong portfolio management is finally possible.

Because many governance teams do struggle to provide leadership to the organizations they are serving, it is appropriate to bring up Patrick Lencioni’s model on the five dysfunctions of a team. The model is shown below with some brief commentary taken from his book, The Advantage³.

Five Dysfunctions of a Team

- The absence of trust – “The only way for teams to build real trust is for team members to come clean about who they are, warts and all.” The absence of trust manifests itself in project portfolio governance when team members are afraid to share their points of view about projects. If most of the governance team wants to approve a project, but one person has a different point of view and simply goes along with the rest of the team and doesn’t share their thought, there is an absence of trust on the team. This leads to the second dysfunction.

- The fear of conflict – “When there is trust, conflict becomes nothing but the pursuit of the truth, an attempt to find the best possible answer”. I love Lencioni’s quote here because conflict is not directed toward other individuals but is for the purpose of finding the best possible answer. Portfolio management is a multi-faceted discipline and everyone on a governance team sees things with a different lens, which is why everyone’s input is necessary. Tragically, governance teams compromise decision quality for the sake of maintaining an artificial sense of harmony among the team. Some corporate cultures avoid conflict and pay a price for it or the governance team owner shies away from conflict and ends up avoiding valuable discussion as a result. The fear of conflict stymies people and brings out mediocrity from a governance team.

- The lack of commitment – “When leadership teams wait for consensus before taking action, they usually end up with decisions that are made too late and are mildly disagreeable to everyone. This is a recipe for mediocrity and frustration”. With trust and the pursuit of the truth, governance team members will buy in and decisions are more likely to stick.

- The avoidance of accountability – “To hold someone accountable is to care about them enough to risk having them blame you for pointing out their deficiencies.” The point here is not to point the finger but have the freedom to hold one another accountable. In the context of portfolio management, I have heard governance teams say that they are at maximum resource capacity yet try to squeeze in “one more project”. Don’t say one thing and do another. Another example might be in the context of Phase-Gate where a project does not meet the minimum thresholds for approval yet one or more governance team members feel strongly to approve it any way. If the governance team holds themselves accountable, they can at least have the discussion as to why an exception is being made for the approval.

- Inattention to results – “No matter how good a leadership team feels about itself, and how noble its mission might be, if the organization it leads rarely achieves its goals, then, by definition, it’s simply not a good team.” Enough said – results matter. The portfolio governance team must see the forest (the portfolio) and the trees (the projects) and be successful at both levels.

Governance Framework to Enable Accountability

While strategic decision making is at the heart of project portfolio governance, a number of processes are needed to support and complement decision making. Processes such as work intake, Phase-Gate, prioritization, and capacity planning processes provide the right information to support the governance team. Setting up these processes effectively and efficiently is also very important to make portfolio management work.

By getting agreement on these governance processes among decision makers, the governance team can utilize this framework in a more harmonious and successful manner. “Those [organizations] with effective governance have actively designed a set of [governance] mechanisms (committees, budgeting processes, approvals, and so on) that encourage behavior consistent with the organization’s mission, strategy, values, norms, and culture” (Weill 2). One of the key words in this sentence is ‘actively designed’. Successful organizations actively design their governance processes to align with their vision, mission, strategy, and culture. By extension, those organizations that haphazardly design their governance processes may struggle and even fail to make good investment decisions. Effective governance is the single most important predictor of the value an organization generates from its portfolio.

Minimal Viable Governance

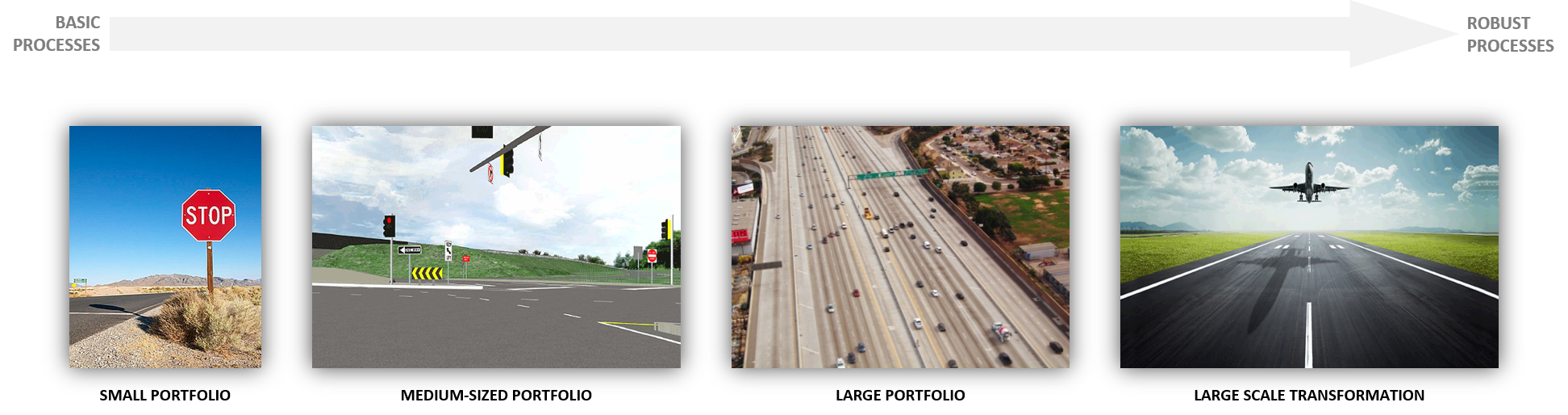

When it comes to developing governance processes, the key is to develop the minimal amount of governance that will help effectively manage your projects and portfolios. We can refer to this as “minimal viable governance”. This is a new term analagous to a minimal viable product (MVP). The idea is to right-size governance to match the size and complexity of your portfolio. Most organizations over-engineer their governance process and it becomes bureaucratic. However, when organizations have little or governance processes in place, it becomes chaotic. One major objection we have heard over the years related to project portfolio management is that it is bureaucratic. The reality is that project portfolio management is only bureaucratic if you have the wrong infrastructure. We can use the diagram below to highlight this.

Small portfolios – For organizations with small portfolios, simple governance is needed. Basic mechanisms about how to approve projects and quickly prioritize them are likely sufficient. This can be likened to a simple stop sign that helps control the flow of traffic.

Medium-sized portfolio – for organizations with a moderate sized portfolio, additional processes may be needed. Specific status reporting and resource management along with Phase-Gate processes may be warranted. This is likened to have traffic lights with additional signage to control the flow of more traffic.

Large portfolio – organizations with a very large portfolio can be likened to a California freeway with multiple lanes of traffic. Stricter processes around Work Intake, Phase-Gate, resource management, portfolio planning and dependency management are warranted in order to protect the portfolio and improve strategic decision-making quality.

Large-scale transformation – in rare cases, large companies take on transformational initiatives that are too big to fail and require a level of rigor not needed for the typical project portfolio. In these cases we see very strict and very prescriptive processes dictate how projects should be run. The air-traffic control analogy is used here because airplanes are controlled in a strict way for safety reasons, a lot of governance and infrastructure is required for airplanes to take off, land, and be maintained. Although some experts like to compare portfolio management with air traffic control, in actuality, very few companies need this level of rigor.

Common Objections to Governance

1) “It will slow us down”

I have heard companies say that adding governance processes will slow down projects. This is like saying stop signs and stop lights slow down traffic. Yes, in a sense, vehicles need to stop at times to make way for other vehicles, but not having traffic lights and stop signs will not make traffic flow faster; it will make it worse. This is an apt analogy for portfolio governance. Project teams may not have to complete as many governance reviews, but without governance there is no way to prioritize work and manage resource capacity. In fact, without governance, more projects will be authorized than can be reasonably completed and will delay the completion of critical projects, just like having a large flow of vehicle without traffic lights will result in gridlock. This is why organizations need to be deliberate with how much governance is needed.

Too much process becomes bureaucratic, but too little process becomes chaotic. The fact is, project portfolio management is only bureaucratic if you have the wrong infrastructure.

2) “We use agile around here”

A common area of resistance comes from the notion that governance is contrary to agile principles. This is not accurate. The Scaled Agile Framework (SAFe) refers to “lean governance” and “lightweight governance”. Solution trains, agile release trains, and program increments are examples of a structure (governance) that enables agile delivery. Furthermore, some level of senior leadership decision making is still needed to firstly determine whether a project (waterfall or agile) should even be done. High-level estimates can still be provided during an intake process to help leadership determine whether it is the right project to do. Teams can leverage various project frameworks and methodologies to do the work right.

Project Portfolio Governance Success Factors

We conclude with a short list of success factors to help improve project portfolio governance. Many of these touch on topics covered earlier in the post, but are based on years of consulting experience.

- Active engagement – coming prepared, being present, asking questions, proposing solutions

- Open, honest, transparent discussions – working comfortably through conflict to find the best possible answer

- Ability to make tough trade-off decisions – preventing misaligned projects from draining critical resources

- Shifting from a singular project view to an aggregate portfolio view – always asking ‘how will this impact our portfolio?’

- Focus on optimizing portfolio value – finding the right combination of projects that unlock greater portfolio value

- Balancing long-term and short-term needs – not always choosing the easy projects

- Communicating a consistent message – reinforcing business goals and objectives; demonstrating this through results

Does any of this ring true for you? If you are struggling with project portfolio governance for portfolio management, contact us.

Tim is a project and portfolio management consultant with over 15 years of experience working with the Fortune 500. He is an expert in maturity-based PPM and helps PMO Leaders build and improve their PMO to unlock more value for their company. He is one of the original PfMP’s (Portfolio Management Professionals) and a public speaker at business conferences and PMI events.

[activecampaign form=3]

¹Weill, Peter; Jeanne W Ross. IT Governance. Boston, Massachusetts: Harvard Business School Publishing, 2004.

²Datz, Todd. “Portfolio Management: How to Do It Right.” CIO.com. Ed. Todd Datz. May 1, 2003. April 26, 2019.

³Lencioni, Patrick. The Advantage. San Fransisco, CA: Jossey-Bass, 2012.

What is portfolio governance?

Project portfolio governance refers to the governance of all projects in the portfolio. Good portfolio governance is about having the right people making good strategic decisions with the right information at the right time. Strong portfolio governance forms the foundation of project portfolio management and is involved in all four components of the portfolio management lifecycle.

Why is portfolio governance important?

Project portfolio governance involves strategic decision making. According to Peter Weill and Jeanne W Ross, effective IT governance is the single most important predictor of the value an organization generates from IT. In fact, it has also been said that portfolio management without governance is an empty concept (Datz). Hence, a well-defined and properly structured governance is critical to manage the portfolio.

What are portfolio governance success factors?

1) Active engagement – coming prepared, being present, asking questions, proposing solutions 2) Open, honest, transparent discussions – working comfortably through conflict to find the best possible answer 3) Ability to make tough trade-off decisions – preventing misaligned projects from draining critical resources 4) Shifting from a singular project view to an aggregate portfolio view – always asking ‘how will this impact our portfolio?’ 5) Focus on optimizing portfolio value – finding the right combination of projects that unlock greater portfolio value 6) Balancing long-term and short-term needs – not always choosing the easy projects 7) Communicating a consistent message – reinforcing business goals and objectives; demonstrating this through results

Never miss an Acuity PPM article

Don't take our word, listen to what others are saying:

"I find value in all of your articles."

"Your articles are interesting and I am sharing them with my team who have limited project knowledge. They are very useful."